Effective Rate vs. Cost Rate: How to Avoid Choosing the Wrong Payment System

A Case Study from Artem Tymoshenko, CEO Maxpay, is recently posted in The Paypers. It’s full text you’ll find below.

“When launching an online business, the biggest issue for a merchant is how to accept payment for his goods or services,” – Artem Tymoshenko.

There’s a huge range of payment providers on the market, and new players appear every day offering “exceptionally advantageous” terms. Whereas reliability and guaranteed payments are quite straightforward – they can easily be checked – the cost rate picture is more complicated than it appears at first sight. Usually, merchants select the provider with the lowest tariff, but the real cost of processing is not always immediately evident. The final percentage of the merchant’s turnover paid for payment processing is known as the effective rate and learning how to calculate it helps merchants determine which tariff is the best deal.

Let’s assume that there are only two countries in a merchant’s traffic structure: the US and France.

The proposal from payment provider:

| US bank | European bank | |

| Tariff | 5% | 2.5% |

| Transaction fee | 20 cents | 20 cents |

| Chargeback fee | 15 dollars | 35 dollars |

The US bank’s tariff is twice that of the European bank, so at first sight, the merchant would be better off choosing the latter (if we leave chargebacks out of the equation). But this is the cost rate – the provider’s standard tariff. If the merchant were to direct his existing traffic through these two channels, he would have faced different costs.

Impact of success rate on effective rate

The success rate is the ratio of successful transactions to the total number of payments submitted for processing. This is usually higher for the US banks, and, in our case, it is 80%, compared to 60% for the European bank.

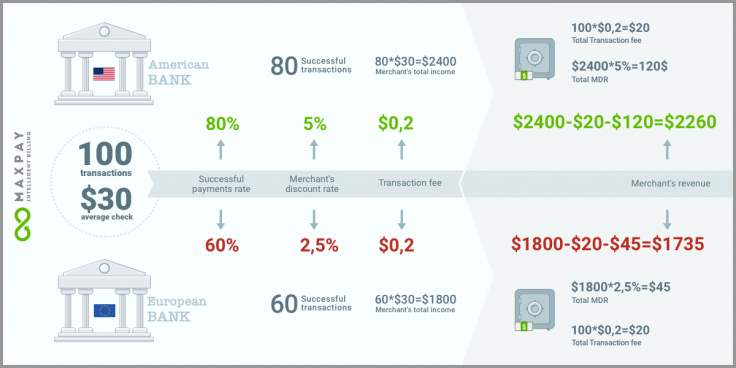

Let’s assume that the merchant has an average sale of USD 30 and he submits 100 payments to each bank. In his case, 20 cents per transaction is just 0.67% of the sale amount, and he will pay the same to each bank – USD 20. However, at the US bank, he processes 80 payments of USD 30, totaling USD 2,400. The transaction fee in this case is 20 / 2400 = 0.83%. At the European bank, he makes 60 payments of USD 30 = USD 1,800. Divide 1800 by 20 and you get 1.11%. The difference of 0.28% between the two effective rates, therefore, depends entirely on the bank, all other things being equal. And this is not to mention the fact that the merchant has received USD 600 more income through the US bank.

At both banks, the merchant will pay the aforementioned percentage on successful transactions, so we can now calculate his income:

Conclusion. As the example shows, in addition to the tariff itself, the effective rate also depends on the transaction success rate. And although the rate is twice as high for the US bank as it is for the European bank, the merchant has earned more there.

In the optimal situation, the payment provider works with several banks in each region and can automatically optimize and redirect transactions to whichever is the most convenient. This helps to minimize the number of rejections and boost the success rate.

Payment for chargeback

A tariff of USD 35 looks worse than USD 15, but if the merchant’s chargeback ratio is very small this tariff will make no difference at all. If a payment provider has a good fraud prevention system it can cover these costs itself, thereby guaranteeing to the merchant that the number of fraudulent operations will be reduced to a minimum with his system.

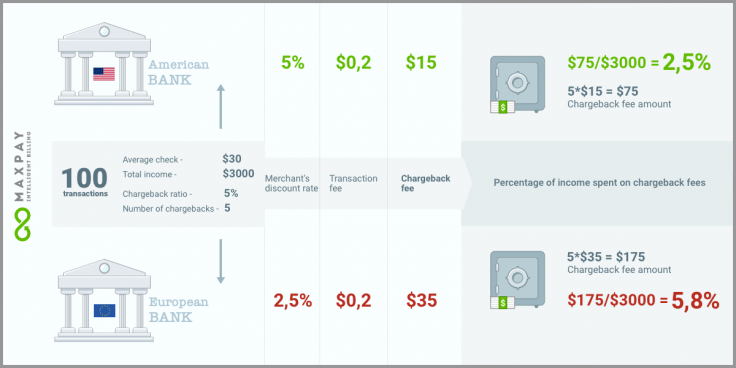

Assuming that our merchant has a chargeback ratio of 5%, let us calculate what percentage of his turnover he will pay in chargeback fees.

As we can see, the cost of the chargeback fee is 3.3% higher with the European bank than with the US bank.

Let us now calculate the overall results for the two banks:

As we can see, our merchant, with an average sale of USD 30, will earn USD 2015 on every 100 payments in the first case, and just USD 1415 in the second. This significant difference is caused by a combination of various factors that are not immediately evident.

How do refunds affect the effective rate?

In the case of a refund, the funds are returned voluntarily, and the merchant’s commission will between 50 cents and USD 1. In the case of a chargeback, in addition to repaying the purchase amount, the merchant pays a chargeback fee to the bank of anything between 10 to USD 30 or even more.

When reviewing refund and chargeback tariffs, the merchant needs to understand what percentage of refunds he has in his business. Some businesses, like Alibaba, sell goods from various suppliers.

The merchant aggregator model presupposes quite a high percentage of partial refunds. As all the vendors on a platform cannot work perfectly or provide satisfactory quality all the time, these business models are, by definition, based on a high percentage of partial refunds. For example, when ordering appliances and clothing, the appliances may be good quality and come with a guarantee, while the quality of the clothing is poor. So refunds can account for 20-30% of turnover. In this case, the refund fee to which nobody paid any attention, can amount to 2-3% of turnover.

Conclusion

The tariff structure is not just about the cost rate figure offered by a payment provider; enticing figures are usually designed only to draw the merchant’s attention. In order to choose the right provider, you have gone into the details, bearing in mind the specifics of your business, its size and the markets in which you plan to operate and work out the tariff for your existing or projected traffic.