Visa aims to reVAMP the dispute management: key changes for merchants

The rapidly evolving payment ecosystem provides ample opportunities for technologically advanced fraudsters and malevolent actors. Visa has previously supported 5 different fraud prevention programs that relied on nearly 40 distinct remediation processes.

As of April 1st, 2025, these procedures will be combined into a single risk management process or VAMP (Visa Acquirer Monitoring Process).

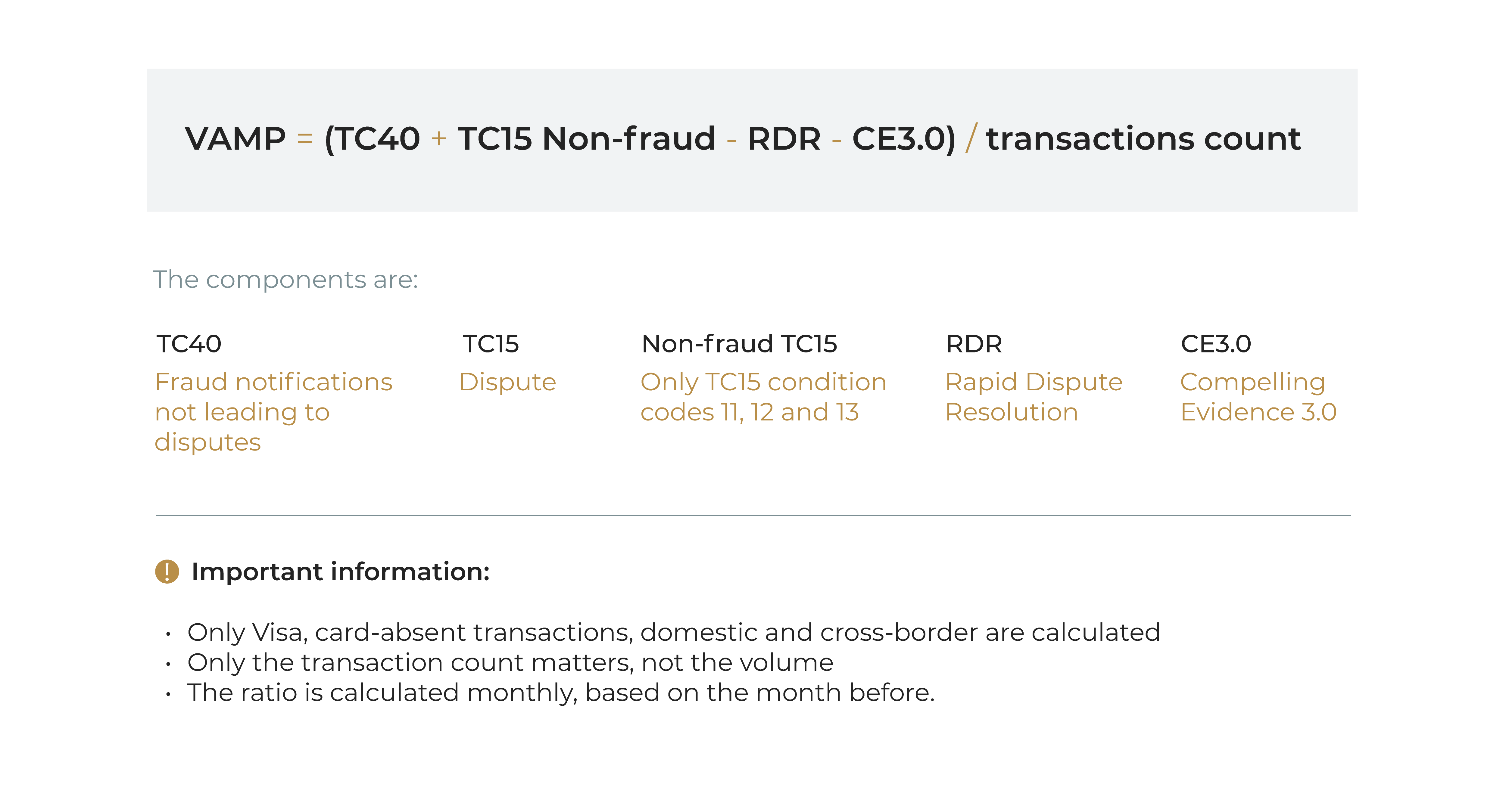

reVAMPed calculations

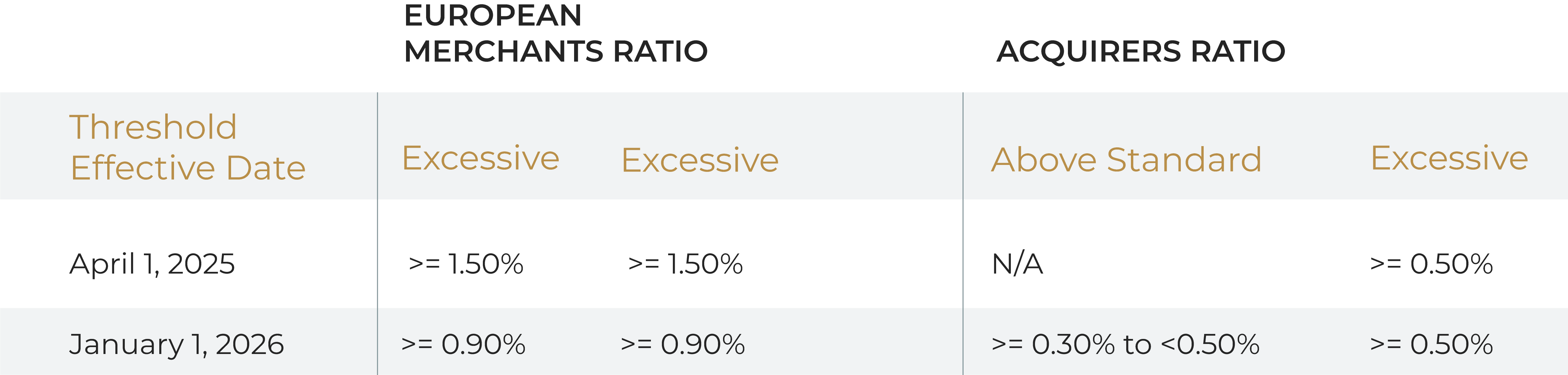

The key changes here are stringent fraud prevention controls and lower thresholds. This is no April Fool’s joke for merchants and acquirers, as VAMP lowers the “above average” rating by 300%, from the current 0.9% to 0.3% by January 2026. The enhanced threshold calculation formula will be as follows:

What does VAMP mean for merchants?

As you can undoubtedly guesstimate, this will mostly impact online businesses relying on regular low-cost transactions (subscription businesses, for example) with comparatively low monthly volumes. While such merchants were previously under the radar, they had the luxury of avoiding Visa attention and minimizing their chargeback losses with “paid trials”.

But, as this reVAMPed chargeback remediation practice will significantly lower thresholds, it can put such merchants on the radar. After all, while Visa expects acquirer banks to scrutinize their portfolio to ensure merchants follow the guidelines — merchants will have to enhance their fraud management and chargeback prevention practices.

It will become much easier (and thus, more preferable) for merchants to avoid chargeback disputes than to go through them. Low-value disputes generate minimal revenue, yet they carry the same weight as full rebill amounts and are more likely to affect the VAMP ratio negatively.

Most impactful VAMP results for the acquirers

As for the acquirers’ side, from April 1st, 2025, more than 0.5% of all transactions across the portfolio resulting in disputes will lead to an “above standard” VAMP rate, imposing a 5$ fee on every dispute across the acquirer’s portfolio. As of January 1st, 2026, the threshold will lower even more, above 0.5% being excessive (with a 10$ fee on every dispute), and from 0.3 to 0.5% being “above standard”.

Needless to say, acquiring banks can rapidly terminate merchant accounts with high dispute counts to stay in the green with Visa and keep a low VAMP profile.

How to prepare for VAMP?

Below are 10 steps merchants can take to ensure compliance with reVAMPed Visa policies.

- Start paying close attention to dispute alerts if you haven’t yet. This can help lower your dispute volumes by as much as 90%

- Participate in the RDR program. Rapidly resolving disputes before they become chargebacks will help keep your VAMP rate low.

- Consider using Maxpay fraud prevention services to keep fraudsters at bay and minimize the time and effort spent dealing with fraudulent disputes and chargebacks.

- Set up clear refund, subscription, and cancellation policies and inform customers about them regularly.

- Your ToS should be clearly visible and easily accessible. Maxpay always highlights the importance of these two points in our merchant onboarding and counseling procedures.

- If you ship goods — track them and keep a record of delivery confirmations. This point is self-explanatory.

- Do your homework before a dispute arises. Store all customer interactions, emails, purchase timestamps, and any other relevant details — they can be your evidence in dispute.

- Keep an eye on fraudulent patterns to identify potentially fraudulent sales sooner. A smart AI-driven fraud detection and prevention solution like Covery can turn this exhausting activity into a mundane automated task.

- Clearly state your pricing. It is always tempting to charge a little bit extra in an ambiguous way. And it is always a bad idea.

- Be in the loop with your PSP and/or acquiring bank(s). While being a routine task, it is of paramount importance. Working with Maxpay you can also automate this task and be informed at once if some fishy activity takes place.

While most of these points are common sense, be sure not to overlook them. The more you implement — the better for your business.

VAMP implementation conditions

Visa held a joint seminar with Verifi Inc. on January 30th regarding VAMP implementation. Here are three key points to pay attention to.

- A fresh start, a clean slate. All ongoing disputes will be resolved by the end of March.

- You can’t be too excessive. “Excessive” statuses under Acquirer and Merchant thresholds are mutually exclusive.

- No additional fees. Once you lower your rate, a new status is applied automatically next month, no extra steps are required.

All in all, Visa aims to make the transition to VAMP seamless for all the parties involved.

Conclusions

VAMP will greatly impact the payments industry, while the exact extent of changes remains to be seen. Staying informed and forewarned can mean being forearmed for what’s to come. Maxpay can help you prepare and streamline your operations, so you save time and resources on potential VAMP compliance issues — and can invest the resources saved into growing your business.

Contact us for a detailed conversation on how Maxpay can help your business succeed!