Why 3DS 2.0 matters more than ever in 2025

As of 2025, the 3-D Secure 2.0 (3DS2) protocol has proven to be a critical tool for online merchants, offering enhanced security and a seamless customer experience. Implementing 3DS2 through a reliable provider like Maxpay can further amplify these benefits, positioning businesses for success in the digital marketplace.

Understanding 3-D Secure 2.0

Developed by EMVCo, 3DS2 is an authentication protocol designed to reduce fraud and provide a frictionless payment experience for card-not-present (CNP) transactions. Unlike its predecessor, 3DS1, which often disrupts the customer journey with additional authentication steps, 3DS2 streamlines the process by transmitting over 100 data points to the issuer. This rich data exchange enables risk-based authentication, allowing low-risk transactions to proceed without additional customer input, positively enhancing the user experience.

Here is how it helps increase profits while reducing risks and building a stronger brand:

- 3DS process helps prevent unauthorized transactions and reduce fraud.

- Shows the end-user (customer’s) direct involvement in the authentication process.

- Emphasizes the merchant’s role in initiating and completing the transaction.

- Reduces reliance on third-party providers, minimizing latency in authentication.

- Optimizes response times, improving user experience and reducing timeouts.

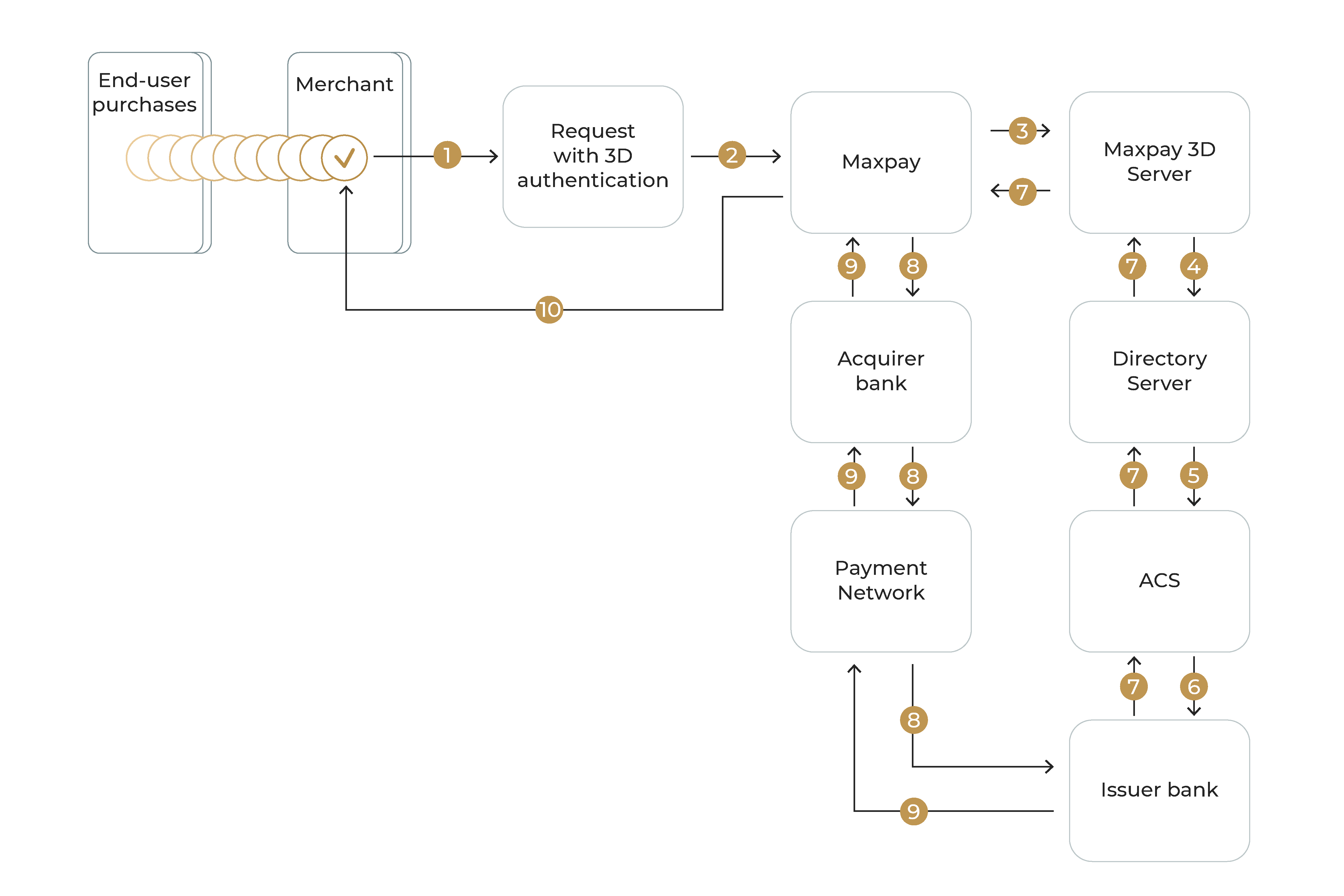

Here is what a 3D Secure transaction flow looks like:

- A customer initiates a purchase that requires 3D Secure authentication.

- The transaction request is sent to the Maxpay Payment System.

- Maxpay forwards the request to its 3DS Server for verification.

- The Maxpay 3DS Server communicates with the Directory Server (DS), which is linked to card networks like Visa and Mastercard.

- The DS forwards the request to the Access Control Server (ACS), managed by the card issuer, to authenticate the cardholder or validate account details.

- The card-issuing bank evaluates and either approves or declines the transaction.

- If approved, the payment proceeds to the Maxpay for final processing.

- Maxpay sends the request to the acquirer for charge. The acquirer returns the transaction result to the issuer bank through the Payment Network.

- The issuer bank passes the transaction to the acquirer bank, which sends the transaction result back to Maxpay.

- Maxpay then notifies the merchant about the final payment status.

This structure ensures seamless flow for low-risk transactions while providing adequate security checks for high-risk scenarios.

How to Implement 3DS in 2025 for Your Business

Even if you are just starting your online merchant journey or are only planning to implement 3DS2 in 2025, have no worries. Below is a simple checklist on how to add 3DS2 to your workflows.

- Assess Your Payment Gateway Compatibility: Ensure your payment gateway supports the latest 3DS version. Many popular payment gateways come with built-in 3DS support and keep it up to date.

- Update to EMV 3DS 2.3.1: Select a Payment Service Provider compatible with the latest EMV 3DS version to benefit from its security upgrades and other features. As of February 2025, Maxpay is among a handful of PSPs worldwide licensed by Mastercard to use 3DS 2.3.1.

- Prioritize Seamless Customer Experience: 3DS’s biggest benefit is its ability to filter out high-risk transactions and add OTP or biometric verification to ensure their security while keeping the flow of low-risk transactions frictionless.

- Perform In-house Training: Your staff must learn all the nooks and crannies of 3DS to solve customer queries quickly.

- Pay Close Attention to Performance: Your PSP should provide analytics tools enabling you to monitor the depth of 3DS impact on your operations. Keep an eye on fraud prevention rates, cart abandonment issues, and general customer satisfaction.

After enabling 3DS, you will have a powerful tool for separating the wheat from the chaff(or checking that it is wheat indeed). This will help you reduce CNP fraud-related issues while keeping your law-abiding customers satisfied and their payment process uninterrupted.

The Importance of Implementing 3DS2

Below are the 3DS2 implementation outcomes we at Maxpay consider the most impactful for our customers.

- Enhanced Security and Fraud Reduction: By incorporating advanced authentication methods such as biometrics and one-time passwords, 3DS2 significantly bolsters security. This robust verification process makes it more challenging for unauthorized users to complete fraudulent transactions, reducing the incidence of chargebacks and associated financial losses.

- Improved Customer Experience: The frictionless flow of 3DS2 allows legitimate customers to complete purchases without interruption. This seamless experience reduces cart abandonment rates and fosters customer loyalty and trust in the merchant’s brand. (see more in our Case study below)

- Regulatory Compliance: In jurisdictions where regulations like the Payment Services Directive 2 (PSD2) mandate Strong Customer Authentication (SCA), implementing 3DS2 ensures compliance. This adherence both avoids potential legal penalties and aligns the business with industry best practices for payment security.

- Liability Shift: Utilizing 3DS2 can shift the liability for fraudulent chargebacks from the merchant to the card issuer. This shift provides financial protection for merchants, safeguarding them against certain types of fraud-related losses.

Advantages of Partnering with a Reliable 3DS Provider Like Maxpay

Selecting the right 3DS provider is crucial for maximizing the benefits of the protocol. Maxpay offers a comprehensive suite of services tailored to the needs of online merchants:

- Seamless Integration: Maxpay’s 3DS2 solution is designed for easy integration with both mobile apps and web platforms, ensuring a consistent and user-friendly authentication process across all customer touchpoints.

- Advanced Risk Management: By leveraging extensive data analysis, the Maxpay system can accurately assess transaction risks, enabling frictionless authentication for low-risk transactions and additional verification for high-risk ones. This approach balances security with customer convenience.

- Regulatory Expertise: With a deep understanding of global payment regulations, Maxpay ensures merchants comply with evolving standards, including PSD2 and SCA requirements. This expertise mitigates the risk of non-compliance and its associated consequences.

- Proven Fraud Reduction: Maxpay’s partnership with Covery, a leading risk management platform, has enabled clients to reduce fraud by up to 95%. This significant decrease protects revenue while improving the overall merchant’s reputation, which is important due to the upcoming reVAMP of merchant and acquirer dispute rates by Visa.

Case study: How Maxpay helped a merchant rectify their approval ratio

A merchant had a low approval ratio due to high quantities of timeouts or expired transactions. The number of declines was ~27-28% of all the transactions, which was based on the merchant’s performance during the previous month. These numbers cut off the Approval Ratio which was ~41-45% based on the last month’s results.

Detailed logs from the Maxpay 3DS Server allowed us to analyze these cases deeply and we saw the entire picture of communication with end-user issuer banks. Maxpay reached out to card brands, ACS, and acquirers. We also reviewed mapping on decline codes, which gave us more precise details about expired 3DS transactions.

Maxpay’s technical capabilities allowed us to investigate the issue overall, based on the reasons listed and end-user experience. We also implemented feedback from all participants of 3DS transactions.

After all the actions Maxpay performed to reduce the number of expired transactions, the merchant’s Approval Ratio improved from 40-45% to 65-72%.

3DS2 Server Impact on Approval Ratio

Optimizing response times directly impacts the Approval Ratio by reducing the number of failed or abandoned transactions due to timeouts. Here’s how:

1. Fewer Timeouts → Higher Completion Rate

In 3D Secure authentication, transactions often fail because the authentication request takes too long, causing timeouts.

A faster 3DS Server ensures quick communication between the merchant, issuer, and card network, preventing unnecessary declines.

2. Reduced User Drop-offs → Bigger Number of Successful Transactions

If authentication takes too long, customers might abandon the payment process.

A responsive 3DS Server speeds up verification, ensuring users complete their payments smoothly.

3. Faster Authentication → Lower Risk of Issuer Declines

Some issuers have internal timeout thresholds. If authentication isn’t completed within a set timeframe, they automatically decline the transaction.

By optimizing response times, the 3DS Server ensures that authentication is completed before these thresholds are exceeded.

4. Improved Communication with Issuers

A well-optimized 3DS Server can proactively retry or adjust authentication flows in real-time, ensuring issuers receive timely and accurate authentication data.

This minimizes soft declines caused by authentication failures.

5. Better Handling of Challenged Transactions

If a challenge (e.g., OTP, biometric verification) is required, a slow response might lead to the user not receiving the challenge in time.

Faster processing ensures that users get authentication prompts instantly, increasing the chances of successful authentication and approval.

As a result of reducing timeouts and improving authentication speed, an optimized Maxpay 3DS Server ensures that more transactions are completed successfully, leading to a higher Approval Ratio and better merchant conversion rates.

Conclusions

As online commerce continues to expand, implementing 3-D Secure 2.0 is no longer optional but essential for merchants aiming to secure transactions and enhance customer trust. Partnering with a reliable provider like Maxpay ensures businesses can effectively leverage the full spectrum of 3DS2 benefits, from robust fraud prevention to seamless user experiences, all while maintaining compliance with global payment regulations.

Are you planning to implement 3DS2 for your business? Contact Maxpay and we will help you every step of the way.